Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

Mhm. There’s two very good reason unrealized gains aren’t taxed: volatility and cash flow. Are you and the government expected to swap cash back and forth everyday to correct for changes in the market? No that’s silly. Should people go into debt because they don’t have the cash to pay the taxes of a baseball card they happen to own that is suddenly worth millions? Also silly.

For that same reason, using unrealized gains as security is dangerous, just like the subprime loans market was!

if you secure debt against them, they should be taxed?

Yeah owning a baseball card worth money sure whatever, if you pawn that card sorry, pay taxes. You use that card a to secure a loan with lower interest rates than you’d get without then sorry, you are realizing gains whether or not you want to admit it. This goes along one of the lawsuits against Trump. He lied to get favorable interest rates by overvaluing his assets to get better interest rates. If that’s against the law why the fuck is that not counted as a “gain” to use assets to secure favorable interest rates?

We’re talking about the stock market. And it would be quarterly or annual. Please stop exaggerating.

There’s a very good reason they should be taxed; half a dozen people are richer than god, and basically never pay any real amount of tax.

This would effectively lock out every small investor from the stock market due to the liability of both success and failure.

How so?

“Oh no, I made money, better put a small percentage of my gains away for tax season, just like I do with all of my income, because I’m American and lack a good PAYE system”.

deleted by creator

Someone here has made a false assumption. In fact, I’m pretty sure we both have made several. The question is who has made a fatal false assumption? Let’s go.

My root comment, at the top of all of this, was my idea that perhaps we should consider gains “realized” when they are sold OR used as a collateral in a loan.

Your assertion is that it would wipe out small investors.

I would question how many small investors are using their small investments as collateral in a loan?

deleted by creator

No it wouldn’t. The proposal out there right now has a floor of something like a million dollars. Most of us will never need to worry about that.

I mean the stock market is literally gambling, so the risk of success and failure is already there. The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan. This would only occur if you’re worth more than 100 million. You can afford to pay that tax.

I mean the stock market is literally gambling

I’ve a better record of success than the most successful poker players. Is it ten years of good luck or the consequences of effort and skill?

The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan.

Thus locking out all non-corporate investors from margin, prerequisite to options, prerequisite to risk mitigation and gains enhancement. The average investor looses the freedom to do much more than DCA a fund.

This would only occur if you’re worth more than 100 million.

-

It’ll never be passed in such a way. Legislation always favors the corporate and wealthy as they’re the ones that write it. It’s most perverse in finance and investment. There’s been nothing favoring human investors since the breakup of Ma Bell.

-

It’s totally inadequate to save the republic from the nearly-unmitigated, algorithmically-optimized capitalism that exists today. The biggest fish, corporations, would simply get bigger by eating their biggest threat: humans with a lot of resources, but not the most affluent.

The stock market is a tool. It’s not the cause.

TL;DR:

The neolib’s proposal is crap.

This isn’t:

-

legislate away most of corporate personhood

-

restore the Glass-Steagall Act

-

repeal the Interstate Banking and Branching Efficiency Act

In no part of your response did you make any sense or a rational point, demonstrating a clear lack of understanding and a wanton disregard for good-faith arguing. Troll gonna troll I guess.

I can’t dumb it down any more. Perhaps another can do so.

-

Sure, but this shouldn’t apply to everybody. Unrealized gains up to $10 million don’t get taxed. Unrealized gains over that amount get taxed.

If you pay it yearly you’re not paying this every day. People with this much money almost always go up in unrealized gains every year, so it’s not going to be a back and forth. It’ll be a yearly adjustment. No different than literally everybody else that pays taxes on their new wealth every year.

Edit: as for the baseball card example, if you’ve got over $10 million in unrealized gains on baseball cards, yeah, maybe you pay taxes on that.

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…

You’d have to put some controls in there for that solution to work. Hitting new homeowners with an immediate tax on “earning” $1,000,000 to pay for their house seems a bit cruel.

The unrealized gains is for 100 millionaires or more. I don’t think there is anyone with 100million in unrealized home value.

I was talking for a hypothetical world where that law isn’t a thing and simply paying capital gains in “realized” gains is.

Nut hey, yeah, sure, 100mil works too.

Capital gains are applied against a cost basis, in the case of your homeowner, their purchase price. Unless the house appreciates in value there is 0 capital gain, even if you made the mortgage a realization event and for some reason implemented this with no residence exemption or tax brackets. It’s mad how this point has to be repeatedly explained through this thread.

Wouldn’t that affect things like Home Equity loans?

No because the mínimum for this to apply is 100 million.

The government also told the public that the income tax was going to apply only to rich people, how’d that turn out?

Depends on the exact implementation, but sure, you could happily write a version where an initial home loan isn’t hit, and only “top up” loans against the INCREASED value of your home is targeted.

This.

deleted by creator

How are you going to enforce that? The Bank can cite whatever they want for giving the loan.

If we just tax them then it’s easily enforceable and it’s done.

It can just be flipped on it’s head;

How are you going to enforce taxing on value, the person can just cite whatever value they want for the asset.

No they actually can’t. In stocks the price is publicly listed by a third party. In real estate an assessor gets involved. For commodities like cars they have to be unique or nearly so before there isn’t a third party listing it’s value.

For edge cases, especially large real estate, we could always make a second law, one that says the government can buy your building at the value you gave the IRS if it’s significantly below market rate on dollars per square foot for it’s type (office, industrial, residential, etc), or that it’s represented as a higher value in investment reports or bank loans. We’ll frame it as a bail out, helping them offload toxic assets. Then the government sells the building on the open market. That way when someone like Trump decides his buildings are suddenly worth less than all of the surrounding buildings we can keep him from going bankrupt again.

https://www.propublica.org/article/trump-fraud-ruling-property-valuation-michael-cohen

A former sitting president has been indicted, if not convicted of this very crime. You’ll have to excuse me if I don’t believe it’s that uncommon.

It took literal decades and the magnifying glass of running for public office. I’m not comfortable with that being the standard.

It is the standard. Now. Currently.

If you don’t like it, might I suggest a guillotine or several. Worked for the French.

Or, we could pass a law changing that standard.

Seems more reasonable than taxing unrealized gains, although I’d prefer if the debate was on how to cut absurd amount of spending rather than trying to find new tax streams.

I’d rather we went back to taxing the rich properly and stopped having crumbling infrastructure.

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

That doesn’t work. It’s not enforceable.

Not enforceable as a law, but not bailing out those who do it is a great way to put an end to it.

I’d rather just have it done than give them another thing they can pressure politicians to bail them out of later.

Then good luck getting a house mortgage because you can’t lend based on future income because it’s not guaranteed. When I bought my house they incorporated the value of my brokerage account. I wouldn’t be able to own a place if they didn’t.

With house mortgages it’s collateralized against the house, a physical object, but it has only a fake value until it’s actually sold because house prices can go up or down.

You’re “free” to die in a cardboard box under a freeway

Actually… They made that illegal. You’re free to rot in prison for being homeless, though!

Sitting here, watching every town council around my area pass a homeless ban after that SCOTUS ruling. Even the newspaper suddenly switched and said popular opinion swung 180 degrees in the last six months.

What the fuck does one do at that point? It’s obviously manufactured consent. It’s blatantly unconstitutional to tell people they can’t exist on public land. It’s a human rights violation to be stuffed into a shelter that demands you be a better human than people who already have housing in order to get house money. At this point we’re just turning the homeless into the new scary minority.

The goal is extermination and genocide. There is nowhere for the homeless to go except into the ground as dead bones, where they won’t bother the privileged and rich anymore.

I don’t know if we’re there, but that’s definitely one way Automation has been theorized to go.

So how does taxing unrealized gains work. If I purchase stock X at a specific price. If the stock goes up and I now am holding 150% of my original value. Let’s say it hovers there for 3 more years. After 3 years it tanks and is now worth only 50% of my original purchases. Are people suggesting that I pay taxes on the unrealized gain of 50%, even though I end up selling at loss and have realized negative value. Doesn’t that mean I am being taxed on losing money? How does that make sense?

The moment you use them as a collateral, they should be taxed as money.

You took a 10 billions loan with the actions you have as collateral? You pay taxes on these 10 billions.

Right now, the system is rigged because the richs get to transform their collateral into liquidity while paying 0 taxes on that, and they can even write off the interest on the interest incurred.

I guess that’s whats lost in the meme. Just because you “can” use something as collateral doesn’t mean you “are” using something as collateral. The language should be more accurate to describe actual use vs hypothetical.

No…see you bought the stock. You don’t have enough of a hoard for us to worry about not to mention the value of that stock will be used in the economy more than likely when You retire or need it.

How it will work is you are an early owner or investor and your hoard pile is over $100 million. Now when your hoard pile goes up 7% you have $107 million. We tax you on your wealth over $ 100 million. Let’s say 25% tax on that $7 million if you choose to hold onto it. Your wealth tax bill will be $1,750,000 that year (plus minus other factors). You can choose to sell your $7 million and it is currently taxed at 18% for realized tax gains if you held onto the stock for over a year or income % tax rate if short term trade.

What this does is increase the public ownership in companies as there is more stock for everyone and decreases the hoarding of companies by the wealthy. It also makes stock prices more honest so people don’t hoard the stock count to inflate prices.

Let’s say you own other assets. A house. It is just like property tax if you can’t afford the tax bill you don’t own the house or…your house isn’t worth that much. If you have tons of homes you may have to sell it to the people rather than rent. And if your hoard of assets is in other random collectibles you pay the tax bill to maintain your collection or share the ownership with others.

As for private companies that will be an interesting thing. I would say when your company is worth $100 million you have to divest the ownership to others. But idk. Legalize will figure it out we can also have exceptions for things like house value or other random things

Unironically, isn’t that exactly how property taxes work on land and housing?

housing exists

deleted by creator

The top 10% own 67% of the wealth in the U.S.

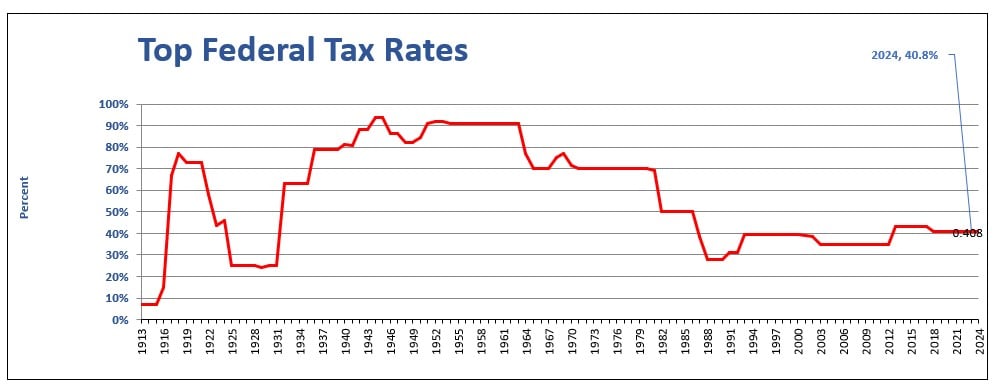

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.

Anyone seriously talking about the 95% rate can be safely ignored as a liar by omission.

The amount of stuff you could deduct was very different back then. Nobody actually paid 95%, regardless of what the law literally said.

There is a reason this person is not showing you per capita tax revenue over the same time period.

That’s how the rich get richer. They never gamble with their own money. They gamble with other people’s money, secured (hah) by their assets.

Yes a minority of us peons who are privileged enough to own property or lots of stocks can play-act like they’re rich by taking out reverse mortgages or doing options trading, but it’s nothing like what the actual rich can get away with.

Ugh. It would be so much simpler to…

… Remember those memes about what you could build with a single pandemic stimulus check? From home depot?

I don’t know man, I don’t really think building millions of birdhouses will accomplish much.

/s 😉

But that means rich people will be slightly less rich. That will never happen.

Please vote for the Tax the Rich Party and not the Gut the IRS Party.

By pay check is unrealized gains. I still have bills to pay. Stop taxing me.

TBH I’m not even considered middle class where I live but I have Unrealized Gains in the form of $VYM and Bitcoin.

I think we should tax loans where stocks are used as Collateral, or set a high bar for Unrealized Gains Tax.

The bar being talked about right now is a net worth of 100million usd, do you have a net worth of 100million? If not your bitcoin is safe.

Maybe some current proposed legislature has set that bar, but this picture of a tweet does not talk about that.

That picture is referencing Kamala’s proposed tax policy where she wants to tax unrealized capital gains on individuals worth 100mill exclusively

The tweet does not say Kamala, it does not mention “The President’s Budget” that was announced by Biden early this year, it just says that unrealized gains are not being taxed.

There is of course the implication of modern policy but I think it is healthy to include nuance and context as I have.

It’s almost like things can exist in a cultural context without explicitly defined connections.

Just say “oh, I didn’t realize” instead of digging your heels in.

Whats your problem, mate? Why is context and discussion banned in your world?

You’ll only help the liars and fiends by painting Kamala’s policy as anything other than what it is.

Says the person doing that exact thing?

That has been the baseline since the beginning. If you aren’t worth 100million there is no reason you shouldn’t support this.

There is no beginning, Unrealized Gains taxes were enforced from the founding of this nation until the late 1960s when general properties taxes in the states shifted to no longer include intangible assets, and have been a hot topic the entire time.

If you’re referring to the President’s Budget plan announced bt Biden early this spring then thats fine. But they didn’t mention it.

Any reported bitcoin savings are unsafe because the database will get leaked. The first rule of Bitcoin is “Never tell anyone how much bitcoin you have.”

Of course, one could always just lie, but that hasn’t been even close to necessary for anyone’s safety yet.

They shouldn’t be taxed because they’re just that, unrealized. They may be worth next to nothing one day. If you use them as collateral, you’re still on the hook for the value you originally took out the loan for, regardless of the loss of the investment.

This argument applies to my wages too if I elect not to be paid in USD. Are you arguing that, say, Bitcoin income should be untaxable just because it could depreciate relative to the USD tax liability it generates.

You’re getting confused between a payment & an investment. The medium in which you are paid is irrelevant. The payment is the end of the transaction and therefore is the point at which it is taxed.

Precisely. The medium of value delivery is irrelevant, as soon as you extract value by borrowing against an asset you have completed a transaction and therefore is a point at which it could (/should though that’s the debate I guess) be taxed.

In both cases (payment in bitcoin or borrowing against stock) your remaining position could go to zero leaving you liable for tax you don’t have money to pay, but that’s on you to manage better.

No, it doesn’t.

Would they be able to use unrealized losses and just end up paying less in taxes than they do now?

If the rich and the poor are fighting, no one can protect the Republic. The founding fathers intended no income tax and for corporations to pay the entire bill. It’s time that became a reality.

Ummm I didn’t know they could be used as collateral. I’ll have to research that. It doesn’t sound right to me for the same reason they definitely should NOT be taxed. How does that even work? You buy stocks and you hold them, then, what the government taxes you every year until there ARE no gains. Or perhaps the stock plummeted and you have a loss, but it’s ok, you lost money on the investment AND to the government. Until you sell an investment you haven’t made any money on it and it should NOT be taxed. If you have a 401k this would affect you too, not just rich people.

There has to be hedging requirements right? If you have 100 million of growth stocks for example, surely you’d need to have put option contracts for that loaning insitution to accept the risk of unrealized assets to secure a loan of that size?

Anyone know how that works? Im sure each loan is reviewed thoroughly for its risk at that level.

Put options are a specific investment vehicle. The OP is just making a blanket statement about unrealized gains. Many, many NOT rich people have unrealized gains. And there literally is NO value to tax. The investment could go bust and there is a loss, no gain at all. At what point in a long term investment is the tax assessed?

But the point of a put contract would be to lock in the strike price for a duration determined by the expiration date. If put contracts were purchased for the duration of the loan, the potential risk of being unable to pay the bank due to depreciation would be mitigated.

Like how farmers buy puts on their commodity to protect themselves from a bad year.

It costs money to buy a put contract to protect the loan.

So if you need a 1mil loan, now you also gotta buy puts that’ll protect a downturn of 1mil. So now you gotta sell stock which will be taxed. It’s less than 1mil so you’re taxed less, but you will have taxes.

Edit: you could zero cost collar (puts + covered calls) your investment to protect it’s current value, but you’ll give up potential gains as well to get the zero cost part. But this would be a way to protect the value without selling. If the options get exercised though, you’d then have some taxes to pay.

Can’t have unrealized gains in a system that doesn’t have stocks. Abolish the stock market.