It’s so crazy to have credit cards, we call them that here in the EU too but there is usually not much “credit” on them and you’re supposed to be on the plus side… What a wild idea.

Credit cards in the US are extremely easy to get and easy to fall into inescapable debt with. I went to a hardware store and signed up for one so I could get 0% financing on some appliances over a year. I asked for like a $2k card. I told them I made $30k a year and they gave me a card with a limit of $8k about 2 minutes later. Now my finances were never even checked, just my credit score. I could have easily lied and said I made way more to get a higher limit, because I actually did lie and said I make less so they wouldn’t give me such a high credit limit. It would be very easy for me to get a higher credit than I have income I think.

It almost sounds like you’re describing a charge card instead of a credit card. American Express offers those in the US, but it’s not nearly as widespread in usage as a standard bank credit card.

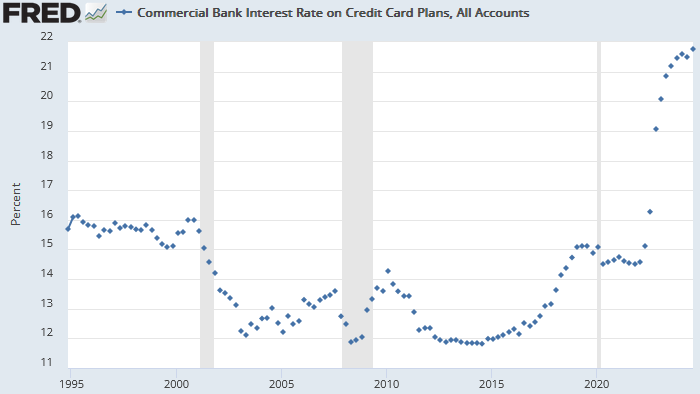

Which is especially worrying considering the interest rate:

Those rates are nothing short of preditory. I’m also going to guess the average consumer doesn’t “shop” for credit cards.

If you’re going to run a credit card balance, which you typically shouldn’t, you might as well make sure it’s costing you as little as possible.

Fixed rate cards and cards from regional banks or credit unions will often offer lower rates.